Horizontal integration represents a corporate strategy where a firm seeks to merge with or acquire another business within the same industry to expand its market share. This approach allows companies to attain economies of scale[1], bolster their market influence, and fortify their competitive stance. Nonetheless, this strategy comes with its own set of complexities, including potential regulatory obstacles and possible cultural discord[2] among the merging companies. The integration could also provoke industry dynamics, fostering a more aggressive market. A prominent instance of this is the Kraft and Heinz merger. Horizontal integration is a subset of the broader merger and acquisition strategy, which also encompasses vertical and conglomerate mergers.

Horizontal integration is the process of a company increasing production of goods or services at the same level of the value chain, in the same industry. A company may do this via internal expansion, acquisition or merger.

The process can lead to monopoly if a company captures the vast majority of the market for that product or service.Other benefits include, increasing economies of scale, expanding an existing market or improving product differentiation.

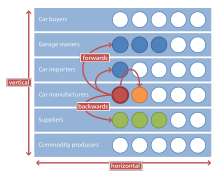

Horizontal integration contrasts with vertical integration, where companies integrate multiple stages of production of a small number of production units.